Have you ever felt like you are working hard but your bank account is standing still? It is a common frustration. You see others moving ahead while you feel stuck in a loop of bills and basic savings. Many people struggle to understand how money truly moves in the modern world. They follow old advice that does not work anymore. This leaves them feeling behind, stressed, and unsure about their future.

Thank you for reading this post, don't forget to subscribe!The latest post cyclemoneyco provides a fresh way to look at your finances. It is not just about saving pennies; it is about understanding the natural flow of money and using new tools to grow your wealth. This guide will help you break out of the cycle of financial stress. We will explore how to manage your money cycles, set up modern digital tools, and build a plan that actually sticks.

Why Financial Cycles Matter Right Now

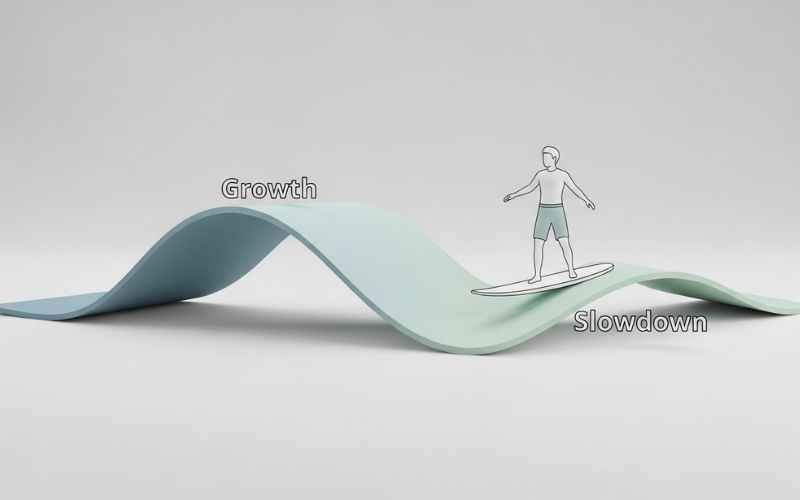

Most people think of money as a straight line. You earn it, you spend it, and maybe you save what is left. But money actually moves in cycles. There are times when the economy grows and times when it slows down. Your own life has cycles too, like when you have big expenses or when you get a bonus.

The problem is that most of us are not taught how to handle these waves. When a “down” cycle hits, it feels like a disaster. The latest post cyclemoneyco teaches that if you plan for the cycle, you can stay calm. By knowing that a slow period is coming, you can build a buffer. This removes the “emergency” feeling from your life. Instead of being a victim of the economy, you become a manager of your own wealth.

Solving the “Paycheck to Paycheck” Struggle

A huge number of people live paycheck to paycheck. Even those with good jobs often find themselves waiting for the next deposit. This happens because their “spending cycle” is too close to their “earning cycle.”

To fix this, you need to create a gap. This is often called a “margin of freedom.” If you can live on 80% of what you make, you create a 20% safety net every single month. Over time, this small gap becomes a bridge that carries you through any financial storm. It turns your money from a source of worry into a tool for peace.

Setting Up Your Modern Digital Wallet

In 2026, how you hold your money is just as important as how much you have. Old-fashioned bank accounts are fine for basic things, but they often lack the features needed for fast growth. Modern digital wallets are changing the game. They use smart technology to help you track spending and even invest automatically.

Choosing the Right Tools

When looking at the latest post cyclemoneyco updates, there is a big focus on security and ease of use. A good digital wallet should:

- Track your habits: It should show you exactly where your money goes without you having to write it down.

- Automate your savings: It should move money to your “future self” the second you get paid.

- Prioritize Privacy: Use platforms that offer end-to-end encryption so your personal transaction data remains your own.

If you are feeling overwhelmed by all the apps out there, start simple. Choose one trusted platform that connects to your main bank. The goal is to make your money management “invisible.” When your savings happen automatically, you don’t have to use willpower to be good with money. It just happens.

Managing Your Personal Money Flow

Managing your money is like being a coach of a team. You need a strategy for every part of the game. The latest post cyclemoneyco approach breaks this down into simple steps that anyone can follow.

The Power of “Paying Yourself First”

This is the most important rule of wealth. Most people pay their rent, their phone bill, and their groceries first. Then they save what is left. The problem? There is usually nothing left.

Instead, flip the script. When you get paid, move a set amount—even just $20—into a separate account immediately. This is your “wealth cycle” money. By doing this first, you treat your future like it is the most important bill you have. You will find that you naturally adjust your spending for the rest of the month to fit what remains.

Staying in Your Financial Lane

One of the biggest causes of money stress is “lifestyle creep.” This is when you earn more money, so you start buying more expensive things. Suddenly, your bigger paycheck feels just as small as your old one.

To beat this, you must “stay in your lane.” Focus on your own goals, not what your neighbors are buying. If you get a raise, don’t buy a new car. Instead, put that extra money into your investments. This allows your wealth to grow while your costs stay the same. This is the secret to getting rich slowly but surely.

Overcoming Common Hurdles with the Latest Post CycleMoneyCo

Even with a good plan, life happens. You might lose a job, or your car might break down. These are the moments where most people give up. But the latest post cyclemoneyco philosophy says these hurdles are just part of the cycle.

Dealing with Debt

High-interest debt is like a leak in your boat. No matter how fast you row, the water keeps coming in. If you have credit card debt, making it go away must be your top priority. Use the “snowball” method:

- List all your debts from smallest to largest.

- Pay the minimum on everything except the smallest one.

- Put every extra dollar toward that small debt until it is gone.

- Take the money you were paying on that one and move it to the next one.

Seeing those small wins early on gives you the emotional boost to keep going. It turns a scary mountain into a series of small steps.

Managing Your Mindset

Money is 20% math and 80% behavior. You can know all the rules, but if you spend when you are sad or stressed, the rules won’t help. Acknowledge that money is emotional. It is okay to feel frustrated, but don’t let that frustration lead to bad choices.

When you feel the urge to spend money you don’t have, wait 24 hours. Often, the “need” for that new item will fade once your emotions calm down. This simple pause can save you thousands of dollars over a year.

Looking Ahead to Your Financial Future

The world is changing fast. Inflation and new technologies can make the future look scary. But by following the principles in the latest post cyclemoneyco, you are building a foundation that can’t be easily shaken.

Wealth is not about having a million dollars tomorrow. It is about having more freedom today than you had yesterday. It is about knowing that if something goes wrong, you are prepared. And it is about knowing that if something goes right, you have the tools to make the most of it.

Your Path to Relief

If you are starting today, don’t try to change everything at once. Pick one thing. Maybe it is setting up a new digital wallet. Maybe it is starting a small automatic transfer to a savings account. Whatever it is, do it now. The “perfect time” never comes, but the “right time” is always today.

By taking control of your financial cycles, you are choosing a life of clarity over a life of confusion. You are deciding that you deserve to feel secure. The path is clear, and the tools are ready.

Frequently Asked Questions About the Latest Post Cyclemoneyco

How can I stop feeling stressed about my monthly bills?

Financial stress usually comes from a lack of “breathing room.” The best way to find relief is to look at your money as a cycle rather than a one-time event. By tracking your spending for just one month, you can see where your money is “leaking.” Many users find immediate emotional relief once they reach their first $500 in savings. Knowing that a small surprise expense won’t ruin your month changes your mindset from being overwhelmed to being in control.

Is it safe to use digital wallets for all my money?

Security is a top concern for everyone in the digital age. Most modern platforms are designed with multiple layers of protection, such as biometric locks and real-time fraud alerts. To stay safe, always use two-factor authentication and never share your access codes. Using a digital wallet for your daily spending cycle is actually safer than carrying a physical wallet because you can freeze your digital account instantly from another device if you notice anything suspicious.

What should I do if my expenses are higher than my income?

This is a painful hurdle, but it is one you can overcome. The first step is to identify “variable costs” that can be paused immediately, such as unused subscriptions or eating out. Frame your budget as a tool for freedom rather than a restriction. If the gap is still too large, look for ways to increase your income cycle, such as a side project or improving your skills for a promotion. Even a small increase in income combined with a slight decrease in spending can fix the cycle quickly.

Which trends from the Latest Post CycleMoneyCo are actually worth following?

The world of finance moves fast, and it is easy to feel confused by new terms and “get rich quick” promises. The most reliable strategies are those that focus on long-term stability rather than instant results. Stick to proven methods like consistent saving, avoiding high-interest debt, and using transparent digital tools. If a trend sounds too good to be true, it likely is. Trust your instincts and focus on the latest post cyclemoneyco principles that emphasize balance and recovery.

How long does it take to see real progress in my finances?

Most people expect to see a huge change in a week, but real wealth is built through small, consistent wins. You will often feel a sense of emotional relief within the first month of tracking your money. By the third month, your new habits will start to feel natural. Within a year, you will likely see a visible difference in your total savings. The key is to stay in your lane and focus on your personal progress every day.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be considered professional financial, investment, or legal advice. While we strive to provide accurate and up-to-date content regarding the latest post cyclemoneyco, financial markets and digital tools are subject to change. Always perform your own research or consult with a certified financial advisor before making any major financial decisions or using new digital payment platforms. We are not responsible for any financial losses or security issues that may arise from the use of third-party apps or strategies mentioned.

You May Also Like: greatbasinexp57 Exposed: Hidden Secrets Everyone Misses

For More Information, visit TryHardGuides.

Shazny plays a key role behind the scenes, reviewing and refining content before it goes live. With a strong eye for detail, Shazny ensures that every article meets high standards of clarity, accuracy, and trustworthiness. From grammar checks to fact verification, Shazny helps maintain the quality and credibility of everything published on TryHardGuides.