Many people feel a sudden rush of fear when they see “plor4d85 pot” on their bank statement. You might feel confused because you do not remember buying anything with this strange name. It is normal to feel panic when your hard-earned money seems to vanish for no reason. You are likely looking for a fast way to stop more charges and protect your cash.

Thank you for reading this post, don't forget to subscribe!I know how stressful it is to face an unknown charge that looks like total gibberish. This guide will help you understand what this term means and why it showed up. We will look at how to get your money back and stay safe. You are not alone in this struggle, and we will find the answer together.

The Mystery Behind the Random Name

The term “plor4d85 pot” is not a real store or a physical kitchen tool. It is often a “billing descriptor” used by companies to show a charge on your credit card. Sometimes, these names are short versions of a company name that you might actually know. However, in many cases, they are used by shady sites to hide what they are selling.

If you see this, you might have signed up for a trial that was not free. Many people forget about small monthly fees for apps or online games. These fees can hide under weird names like this one to keep you from noticing. It is a common hurdle that makes managing your monthly budget very hard.

Why the Name Looks Like a Code

The “plor4d85” part looks like a secret code because it helps computers track digital sales. Banks use these strings of letters and numbers to sort millions of deals every single day. The word “pot” might refer to a specific group of products or a digital “pot” of money. It is not meant to be read easily by humans, which adds to the frustration.

When you see a name like this, it often points to a “payment gateway.” This is a middleman that handles money between you and a website. If the website is not famous, they use the gateway’s random name instead of their own. This lack of clarity is a major pain point for anyone trying to track spending.

Identifying a Potential Billing Scam

It is important to know if “plor4d85 pot” is a real charge or a scam. Scammers often use random names to test if a credit card is active. They start with a small amount to see if you notice the missing money. If you ignore a small one-dollar charge, they might try to take much more later.

You should look at the specific date of the charge on your bank app. Compare it to your emails to see if you got a digital receipt recently. If there is no email, the charge is likely not one you made on purpose. This is a red flag that means your card data might be in the wrong hands.

How to Handle a Billing Dispute Properly

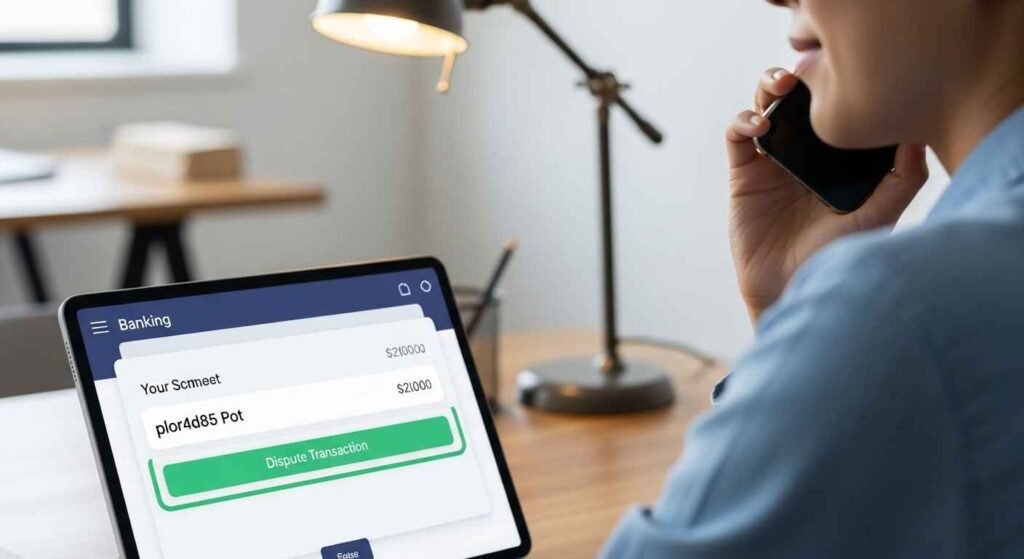

If you did not buy anything from “plor4d85 pot,” you must talk to your bank. Most banks have a simple way to “dispute” a charge through their mobile app. This means you tell the bank the charge is wrong or totally fake. They will then look into the matter for you and try to get the money back.

Calling the number on the back of your card is the best first step to take. Tell the agent that you do not recognize the name and never authorized the deal. They will likely cancel your current card and send you a brand new one. This stops the “plor4d85 pot” entity from taking any more of your money today.

Protecting Your Digital Privacy From Thieves

Your data might have leaked from a site you used many months ago. When hackers get card lists, they sell them to people who make these small charges. Using a password manager can help keep your private accounts much safer than before. It is also wise to turn on “text alerts” for every purchase you make.

When you get a text for every dollar spent, you see the charge the moment it happens. This lets you stop the thief before they go on a big shopping spree. Being proactive is like having a digital shield for your bank account. It turns a scary situation into a small task you can handle easily.

Finding the Source of the Unknown Charge

Sometimes, “plor4d85 pot” is linked to a specific type of online subscription service. Many people find these names attached to “adult” content or online gambling sites. These businesses use boring or weird names so they do not stand out on a bill. If you share your card with others, ask them if they signed up for something.

You can also search the name online to see if others are complaining about it. If many people say it is a scam, then you know for sure what happened. If there are no results, it might be a very new or very small company. Either way, if you didn’t buy it, you should not pay for it.

Common Reasons for the Charge

- Hidden Subscriptions: You might have joined a “free” club that now costs money every month.

- App Store Purchases: Mobile games often use weird codes for buying in-game items or gold.

- Foreign Fees: Shops in other countries often use different billing systems that look like gibberish.

- Data Entry Errors: A clerk might have typed the wrong merchant code into a credit machine.

Recovering Your Lost Funds Safely

The good news is that most credit cards have “zero liability” rules for users. This means you are not responsible for fakes if you report them in a timely manner. Debit cards are a bit different, but they still offer some protection for your cash. You must act within sixty days to have the best chance of a refund.

Once you report the “plor4d85 pot” charge, the bank starts a process called a “chargeback.” They take the money back from the merchant’s bank account to pay you back. This process can take a few weeks, so you must be very patient. Keep a record of your call and any case number the bank gives you.

Staying Safe from Future Scams

To avoid seeing “plor4d85 pot” again, be careful where you save your card data. Avoid clicking “remember my card” on sites you do not use every single day. Use “virtual cards” if your bank offers them for online shopping. These are fake numbers that only work for one specific online shop.

If a site asks for a card for a “free trial,” it is often a trap. They hope you will forget to cancel so they can charge you under a weird name. Set a timer on your phone to cancel the trial a day before it ends. This simple habit saves you from hours of phone calls with bank agents.

Why These Charges Often Go Unnoticed

Many people do not check their bank statements every single day of the month. Scammers know this and use it to their advantage when stealing money. They pick names like “plor4d85 pot” because they look like boring tax or utility codes. Most people just assume it is a fee they forgot about and move on.

By the time you notice the theft, the scammers might have taken hundreds of dollars. This is why looking at your bank app once a day is a great habit. It only takes one minute to scan for names that do not look right. Catching a small charge early can save your entire life savings from being drained.

The Role of Data Breaches in Fraud

Most people wonder how a stranger got their credit card number in the first place. Often, a large store or website you used in the past had a “data breach.” This means hackers broke into their computers and stole a list of customer cards. Your name and number might have been on that secret list for months.

Once a list is stolen, it is sold on the dark web to smaller crooks. These crooks then use automated bots to try the card numbers on different websites. The “plor4d85 pot” charge is often the result of one of these bot tests. If the bot succeeds, the human thief knows your card is ready for use.

How Merchant Category Codes Work

Every business that takes credit cards has a “Merchant Category Code” or MCC. This four-digit number tells the bank what kind of items the store sells. Sometimes, the bank statement shows the MCC name instead of the store name. If the code is for “General Merchandise,” it might show up as something like “pot.”

The letters and numbers before it are usually unique to that specific store branch. This system was built decades ago and was never meant for the modern internet. That is why digital charges look so confusing compared to buying milk at a local grocery store. Understanding this system helps lower the stress when you see a weird code.

Steps to Take if Your Identity is Stolen

If “plor4d85 pot” is just one of many weird charges, your identity might be at risk. This is a much bigger problem than just one bad charge on a card. You should check your credit report to see if someone opened a new loan. There are free websites that let you check your credit score and history easily.

If you see a new loan you did not take, you must “freeze” your credit. This stops anyone from opening new accounts in your name for any reason. You should also change the passwords on your email and your main bank account. Using a different password for every site is the best way to stay safe.

Immediate Action Steps

- Call Your Bank: Report the “plor4d85 pot” charge as soon as you see it.

- Lock Your Card: Use your bank app to freeze the card so no more money leaves.

- Change Passwords: Update your login info for any site that has your card saved.

- Scan Your Computer: Run a virus scan to make sure no one is watching your typing.

The Importance of Official Receipts

Always keep your digital receipts in a separate folder in your email inbox. If you see “plor4d85 pot,” you can search that folder for the exact dollar amount. Sometimes, you will find a receipt from a site you actually used that day. The receipt might explain that the “billing name” will look different on your bank statement.

Legitimate sites often put this warning on their “Thank You” page after you buy. They know their billing name is confusing and want to help you avoid a mistake. If you find a matching receipt, then you know the charge is safe. If there is no match, then you can proceed with a bank dispute.

Understanding Payment Processing Fees

Sometimes a charge like “plor4d85 pot” is actually a tiny fee for moving money. If you use apps to send money to friends, they might charge a small percentage. These apps often use weird codes to track these internal fees for their own taxes. Check your recent money transfers to see if the math adds up.

Small fees can also happen if you buy something in a different currency. If you buy a shirt from a UK shop, your US bank might charge a “conversion fee.” This fee often shows up as a separate line with a coded merchant name. It is usually only a few cents or a few dollars at most.

Why You Should Not Call the Number on the Screen

If you see a pop-up telling you to call a number about “plor4d85 pot,” stop. Real banks will never use a browser pop-up to tell you about a bad charge. These are “tech support scams” designed to get you on the phone with a liar. They will try to trick you into giving them remote access to your computer.

Always use the phone number from the official bank website or the back of your card. Never trust a number provided in an email or a random website search result. Scammers often pay for ads to show their fake help numbers at the top of Google. Going to the official source is the only way to stay truly safe.

The Future of Secure Online Shopping

Banks are working on new ways to stop confusing charges like “plor4d85 pot.” Some are moving toward “richer data” that shows the store’s logo and map location. This makes it much easier to see exactly where your money went at a glance. Until every bank uses this, we must stay careful and check our own bills.

Using mobile wallets like Apple Pay or Google Pay also adds a layer of safety. These services do not give the store your real credit card number. Instead, they give a “one-time code” that only works for that one single purchase. This makes it impossible for a thief to charge your card again later.

You May Also Like: Is 01438 989230 Safe? Critical Info Every UK User Must Know

Final Steps for Peace of Mind

Once you have disputed the charge and got a new card, take a deep breath. You have done the hard work of protecting your finances from a mystery threat. Most people go through this at least once in their lives as the world moves online. It is a learning experience that makes you a smarter and safer shopper.

Keep your new card info away from shady websites and “get rich quick” schemes. If a deal looks too good to be true, it probably is a trap for your data. Stay curious and keep asking questions whenever you see something you do not understand. Your financial health is worth the extra minute of checking your bank statement every day.

Quick Safety Checklist

- Review your bill monthly: Look for any name that seems like a code.

- Update your passwords: Do this every few months to stay ahead of leaks.

- Enable two-factor login: This makes it harder for thieves to use your accounts.

- Trust your gut: If a site looks messy or “off,” do not give them your card.

Frequently Asked Questions

Is plor4d85 pot a real company?

No, it is likely a billing code or a fake name used by a scammer. Most real stores use names that people can recognize easily on their bank bills. If you see this name, it is a sign to check your recent purchases very carefully.

How did they get my credit card number?

They likely got it from a data breach or a phishing website you visited. Scammers buy lists of card numbers from the dark web to try them out. You might have also entered your card into a fake “free trial” site by mistake.

Can I get my money back from this charge?

Yes, most banks will give your money back if you report it as fraud. You need to call your bank as soon as you see the “plor4d85 pot” name. They will start a dispute and send you a new card to keep you safe.

Should I cancel my credit card immediately?

Yes, it is a good idea to cancel the card and get a new one. If a thief has your number, they will keep trying to use it for more buys. A new card number stops them from taking any more of your money in the future.

Does this mean my identity is stolen?

Not always, as it might just be a “card-only” theft from a database. However, it is a good idea to check your credit report just to be safe. Free tools online can tell you if any new accounts were opened in your name.

Disclaimer:

The information in this article is for educational purposes only and does not constitute professional financial or legal advice. While we strive for accuracy, we make no guarantees regarding the completeness or reliability of this content. Use of this information is at your own risk. Always consult with your bank or a certified financial advisor before making decisions regarding your accounts or disputed charges.

Evelyn White is an experienced content writer with a background in lifestyle, trends, and practical advice. With several years of writing across digital platforms, she specializes in making everyday topics accessible, informative, and engaging. Her goal is to deliver trustworthy, reader-focused content that’s both useful and easy to understand.